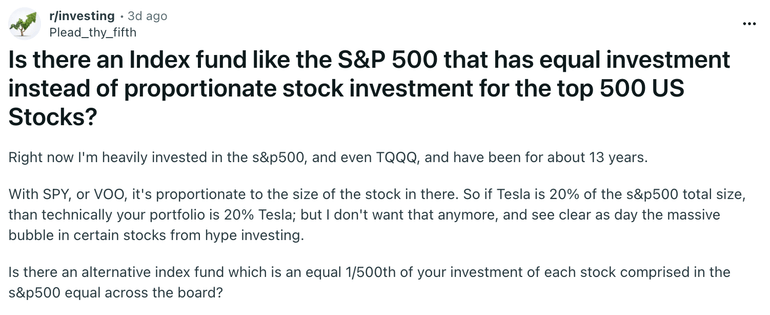

Over the summer, we wrote in our email newsletter, Nervous investorsabout how a handful of stocks dominate the S&P 500 — and how NVIDIA in particular dominates the index. (You can read this issue Here.) Now, it seems Reddit is taking note…

To answer Plead_thy_fifth’s question: There are indeed a number of such exchange-traded funds. They’re called equal-weighted S&P 500 ETFs, and we look at their pros and cons below.

Side note: Plead_thy_fifth refers to a “massive bubble” in his post, and he’s not alone in that theory. Even OpenAI CEO Sam Altman has speculated that we may be in an AI bubble. I discussed this in a A recent episode of NerdWallet’s Smart Money Podcast. Nervous Investor took a more in-depth look at the AI bubble theory in our December issue (you can read it Here)

Two Equally Weighted S&P 500 ETFs and Their Fees and Returns

At the time of writing, there are two unprofitable equal-weight S&P 500 ETFs on the market. They are listed below. The data is obtained from the Vitafi, Google Finance and Fund websites, is current as per the market as of December 2, 2025, and is intended for informational purposes only.

Invesco S&P 500 Equal Weight ETF (RSP) The expense ratio is 0.20%, and the year-to-date growth is 8.77%. Its average dividend yield over the last 30 days is 1.63%.

Invesco S&P 500 Equal Weight Income Gain ETF (RSPA) The expense ratio is 0.29%, and the year-to-date growth is 1.48%. It sells options on its holdings to generate additional income. Its average dividend yield over the last 30 days is 9.05%.

Equal-weighted S&P 500 ETF pros and cons

CON: High fees and low returns. Vanguard S&P 500 ETF (Wo), the largest S&P 500 ETF by assets under management, has an expense ratio of 0.03% and an annualized yield of 16.58%. These have significantly lower fees and higher returns than any of the above-mentioned equally weighted funds.

Pro: Potentially more protection against a tech bubble. The top 7 stocks in VOO, all of which are large-cap tech stocks, make up about one-third of the ETF’s holdings, despite being an S&P 500 ETF. In the aforementioned equal-weighted funds, however, each stock accounts for roughly the same percentage of the ETF’s holdings. If something goes wrong with Big Tech in the next few years—say, if it turns out the AI boom has been overextended—an equal-weight ETF might not fall as much as a market-cap-weight S&P 500 ETF like Wu.

Pro: High profitable production. Wu’s average yield over the past 30 days is 1.10%, which is lower than the above-mentioned equal-weighted funds. Many of the big tech stocks that regularly dominate S&P 500 ETFs like Wu don’t pay dividends, so equal-weight ETFs may be better for income investors.

Advertisement

Nerdwallet rating 4.8 /5 | Nerdwallet rating 4.5 /5 | Nerdwallet rating 5.0 /5 |

The fee $0 Per online equity trading | The fee $0 Other fees apply per trade. | The fee $0 Trade for US stocks and ETFs online |

Promotion None There are currently no promotions available | Promotion Get up to $1,000 When you open and fund an e*commerce brokerage account. Terms apply. | Promotion None There are currently no promotions available |

Other equally weighted index funds

There are ETFs with equal weights on indexes other than the S&P 500.

It is the largest equal-weighted Dow Jones Industrial Average ETF by assets under management First Trust Dow 30 Equal Weight ETF (Edo). It has an expense ratio of 0.50%, a year-to-date ratio of 13.62%, and an average dividend yield over the last 30 days of 1.41%.

The largest equal-weighted Nasdaq 100 ETF by assets is First Trust Nasdaq 100 Equal Weighted Index Fund (QQ). It has an expense ratio of 0.55%, a year-to-date ratio of 14.24%, and an average 30-day yield of 0.44%.

The bottom line on the equal-weighted S&P 500 ETF

If you’re concerned that your index funds are too concentrated in big tech, equal-weight S&P 500 ETFs are a possible solution that could see less volatility if the biggest tech stocks start to underperform. They also typically offer higher returns than the typical S&P 500 ETF.

But if the big tech does not A skewed, equal-weight S&P 500 ETF can lag its market-cap-weight counterparts in terms of returns—especially after their fees, which are higher than typical index funds.

More on index fund investing

The author owned shares of the Vanguard S&P 500 ETF at the time of publication.