You’re as likely to find a commercial P/C underwriter or actuary who is unconcerned about the growing use of AI in insurance as you are to find one that fears being replaced by AI.

A recently published report by Hyperexponential, an AI-powered pricing and underwriting platform, showed that based on a September survey by Coleman Parks of 350 US and UK underwriters and actuaries working in commercial and specialty insurance for the firm.

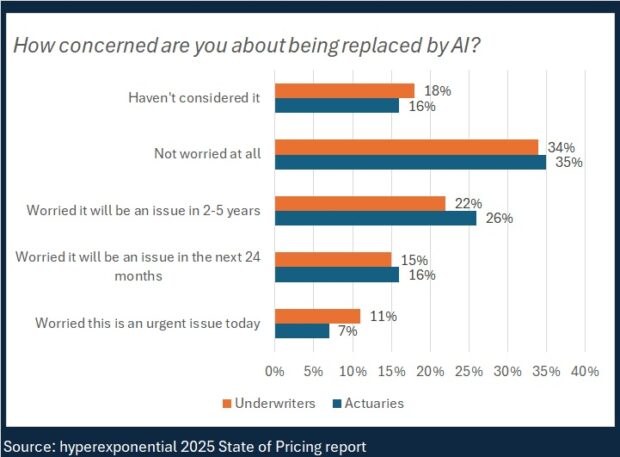

More than half of those surveyed — 51 percent of actuaries and 52 percent of underwriters — said they were not at all worried or had not considered the possibility of AI replacing them.

According to HyperExponential, an important way to snapshot survey responses is the marked difference between responses this year versus responses to a similar survey in 2024.

“Underwriters (48 percent) and actuaries (49 percent) are expected to be less than 74 percent and 80 percent by 2024, respectively,” the tech firm said in a media statement.

For both groups, just over a third of respondents said they have considered the issue of AI replacing them but are not worried at all.

Beyond the information on this, “fobo”—that’s the word for obsolescence—”Pricing to 2025” report reveals insurance tech and automation investment trends and provides insight into the degree of collaboration between actuaries and underwriters as viewed from each camp’s perspective.

This year’s survey indicates real progress, the report said. In support of this, the text of the report notes that underwriters ranked pricing actuaries second only to operations professionals when asked how effectively they collaborate with other functions. In the previous (2024 State of Pricing) report, underwriters ranked pricing actuaries last among collaborators within companies.

Still, “the upside is difficult,” the report said, with only 9 percent of actuaries asked about underwriter support rating them as “very effective.”

“Actuaries create models for underwriters but are often not with them,” the report said.

Charts in the report show that underwriters rated the effectiveness of collaboration with pricing actuaries at an average of 3.5 out of 5. Actuaries put the support rating score at 3.1 out of 5. This was lower than the scores of operations, legal and finance professionals.

Responding to a different survey question—about barriers to maintaining and deploying pricing models—38 percent of actuaries cited “lack of underwriter or business buy-in” as a barrier. Meanwhile, 45 percent of underwriters said “pricing models are inaccurate or out of date” when asked to identify barriers to greater underwriting.

Investment increases

Much of this report focuses on technology-related investments that insurance companies have and are currently having with the tools they are using.

In a forward to the report, Hyperexponential Chief Executive Officer and Co-Founder Amrit Santhrasinan wrote, “Almost every insurer identified pricing and underwriting as high priorities for technology investment, indicating that these functions are key engines of intelligent decision-making.”

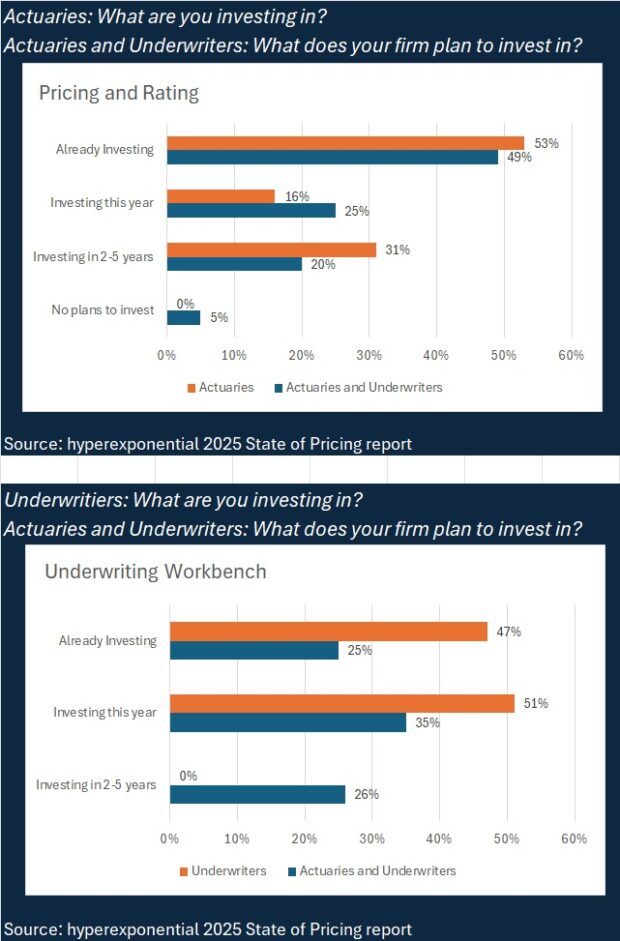

According to the survey, 100 percent of actuaries surveyed are investing or planning to invest in pricing and rating technology in the next five years, while 98 percent of underwriters are investing or planning to invest in an underwriting workbench solution within the next year.

The responses of each group individually and both groups combined are shown in the chart below:

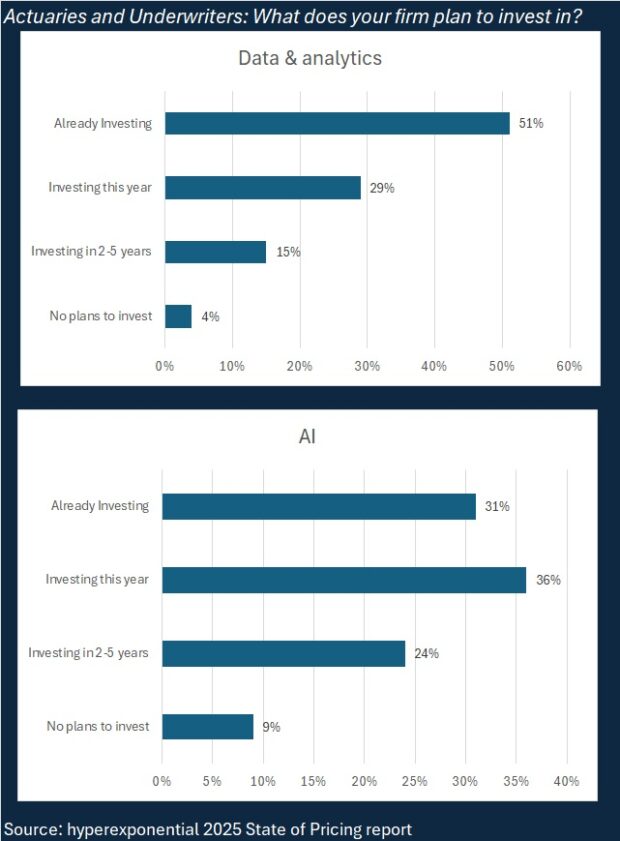

Across both groups, 94 percent said their organizations are investing in pricing and ranking tools in the next five years (or are already doing so). Data and analytics investments rank high, with 95 percent of survey respondents indicating their firms are investing in data over a five-year period (51 percent already investing).

While only 31 percent said their firms are already investing in AI, another 36 percent said their firms are investing in AI this year. All told, two-thirds said AI investments are happening—or will happen—within 12 months.

Commercial and specialty insurers continue to invest in existing and emerging technologies, but 99 percent said they struggle with getting tools to work as they expect.

Comparing the 1 percent satisfaction rate with the 22 percent satisfaction rate two years ago (in a Comparison 2023 report), Hyperexponential suggests that the growing disillusionment gap “doesn’t indicate deteriorating technology but rather rising expectations.”

“Actuaries and underwriters have seen what’s possible when data science, automation and AI meet real-world valuations. The bar has been raised, and Excel can no longer clear it,” the report said.

Concerns turn to skill gaps

Beyond these frustrations, the report indicates that while underwriters and actuaries no longer worry about managing their jobs, they do worry about not being equipped to leverage AI effectively. When asked about their top concerns, each group ranked “not having the right skills for the future” in their top three.

According to a media release about the report, nearly three-quarters of underwriters said they felt they needed data analysis and reporting skills to keep pace with price changes, and 80 percent said they lacked key skills such as coding. Among actuaries, more than 80 percent gave the same response.

In addition, 73 percent of underwriters and 74 percent of actuaries said burnout was a growing concern, the statement said.

“Underwriters are understandably feeling the pinch after spending up to three hours a day on manual tasks like data entry, quoting and reporting. Meanwhile, 70 percent of actuaries say faster, more accurate pricing models will change their role, up from 39 percent last year,” the statement said.

Separately, in September, Accenture published similar survey responses in an update to a survey published three years ago. More than a third of an underwriter’s time is still being spent on non-core activities such as negotiations, sales, risk analysis and pricing rather than core activities, according to the latest Accenture survey of 215 senior insurance P/C underwriting executives and 215 life underwriting executives published in the firm’s “Underwriting Rewrite” report.

Accenture shows some additional improvement for commercial P/C underwriters, who report spending 35 percent of their time, up from 38 percent three years ago. For personal letters, the movement was greater. The underwriters also said that non-core activities consumed 35 percent of their time, but that’s down from 45 percent, according to previous studies.

Taking a slightly different take on AI, Accenture asked underwriters to what extent they were using different technologies over the next three years. For AI, less than 15 percent said they are using various AI-based capabilities today, and 70 percent expect to use them in three years. .

Like the U.S. and U.K. underwriters and actuaries surveyed for the Hyperexpansion Report, most underwriting executives in the eight countries surveyed by Accenture are not afraid of obsolescence, but are valuing the need for upskilling.

According to an Accenture report, 81 percent of investing executives believe that AI and general AI will create new roles “to a large extent” or “to a very large extent.”

According to the Accenture report, nearly two-thirds (65 percent) said upskilling will be needed as AI becomes essential to create new roles and augment existing ones.

Actuaries and underwriters surveyed for the Hyperexponential Report were asked to describe what skills their professions will need in the future. Expertise in data analysis and reporting topped both lists — flagged by 52 percent of underwriters and 62 percent of actuaries.

Their response signaled a shift away from soft skills. Notably, emotional intelligence was selected as a key attribute for future insurance professionals by only 14 percent of respondents.

Titles

InsurTech Data is powered by artificial intelligence