Disclosure: Our goal is to feature products and services that we think you will find interesting and useful. If you buy them, the entrepreneur may receive a small share of the revenue from our commerce partners’ sales.

Demand for lithium is fueling the modern-day gold rush.

Industries that define our modern world, such as artificial intelligence (AI), robotics, EVs and energy, all depend on lithium, which is used to make batteries and other energy storage systems. Microsoft CEO Satya Nadella believes the AI race will be won based on energy costs, not on who has the best models.

That’s why lithium demand is expected to grow by a staggering 5x by 2040.1 This development is an opportunity for investors. As Elon Musk put it bluntly, “Do you like investing money? Well, the lithium business is for you.”

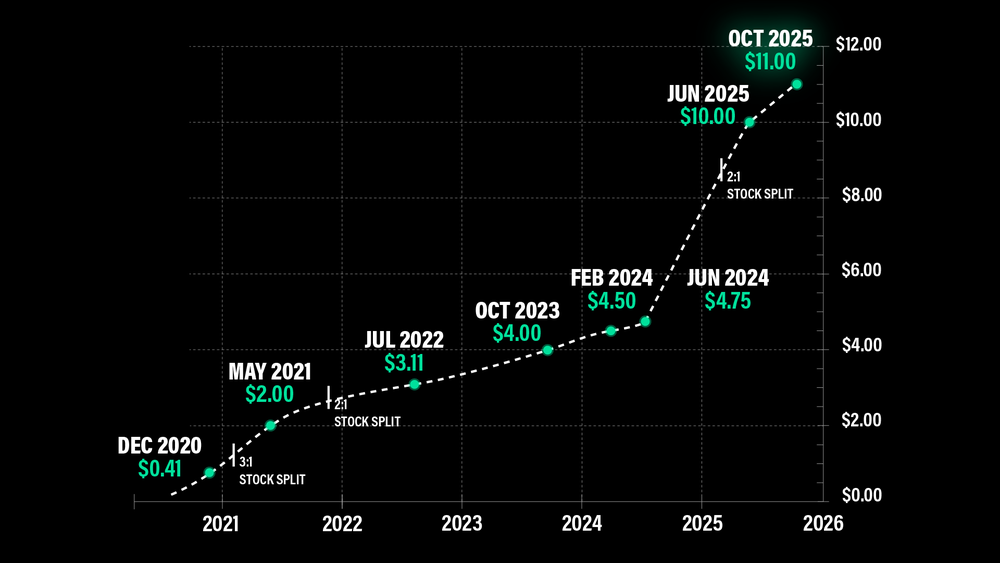

One company translated this demand into substantial price gains since 2018, officially reaching b1b unicorn territory last year.

Meet EnergyX. It has developed a patented technology that the company says can recover 3x more lithium than conventional methods. The company says this development has already earned them more than $150 million in investment, including strategic investments and partnerships from General Motors and POSCO, and a $5 million U.S. Department of Energy grant.

Image credit: EnergyX

*Prices shown have been adjusted to reflect stock splits.

Now, EnergyX is at a critical transition stage, moving from proving the technology to commercial-scale deployment, just as global lithium demand accelerates.

Here’s why investors are paying attention.

- 1 1.1B/year revenue potential 100K+ acres of Chilean land at expected market prices.

- Goldman Sachs is engaged as a financial advisor On the Chile project.

- About 50,000 gross acres of land are reserved for production In Arkansas and Texas.

- An LOI for 90 690M Federal Loan from EXIM Bank is on the table to support mass construction.

- EnergyX just announced an expansion into nuclear power, an industry Bank of America calls a $10 trillion opportunity by supplying key lithium isotopes.

With proven tech and resources, growing institutional support, a market poised for major growth, and emerging new verticals, the opportunity for today’s investors couldn’t be better.

This is especially true considering that, due to increased investor demand, EnergyX’s share price will subsequently increase. February 26.

This is your chance to claim your stake in a private unicorn with General Motors, POSCO, and over 40,000 everyday investors.

Get your piece of this modern-day gold rush before its share price rises. Become an early stage Energy X shareholder today.

1 Global energy, lithium demand to grow fivefold by 2040, cobalt demand to grow by one and a half times (2025)

Disclaimer:

Energy Exploration Technologies, Inc. (“EnergyX”) has engaged Entrepreneur to publish this communication in connection with EnergyX’s ongoing regulatory offering. The entrepreneur is paid in cash and may receive additional compensation. The business and/or its affiliates do not currently hold securities of EnergyX.

This compensation and any current or future ownership interest may create a conflict of interest. Please consider this disclosure in conjunction with EnergyX’s offering materials. Regulation of EnergyX An offering has been qualified by the SEC. Offers and sales can only be made through qualified offer circulars. Before investing, carefully review the offer circular, including the risk factors. The offer circular is available at investment.com/

Under Regulation A+, a company has the ability to change its share price by up to 20% without requiring a filing with the SEC.

Demand for lithium is fueling the modern-day gold rush.

Industries that define our modern world, such as artificial intelligence (AI), robotics, EVs and energy, all depend on lithium, which is used to make batteries and other energy storage systems. Microsoft CEO Satya Nadella believes the AI race will be won based on energy costs, not on who has the best models.

That’s why lithium demand is expected to grow by a staggering 5x by 2040.1 This development is an opportunity for investors. As Elon Musk put it bluntly, “Do you like investing money? Well, the lithium business is for you.”

One company translated this demand into substantial price gains since 2018, officially reaching b1b unicorn territory last year.