A category of insurance risk that barely existed a decade ago has become a meaningful source of losses for the industry.

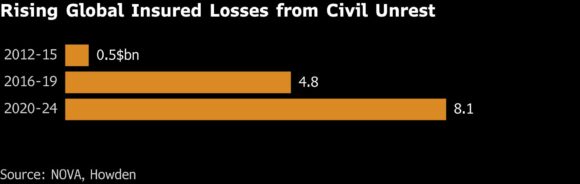

Claims linked to SRCC – strikes, riots and civil unrest – are emerging as a growing headache for insurers as episodes of unrest continue to cause property destruction in Western democracies. Howden Re estimates SRCC-related insured losses to grow from negligible in 2013 to more than $8 billion between 2020 and 2024.

SRCC losses fluctuate greatly between years, with single events often changing the landscape significantly. After relatively few claims globally in 2025, Howden Re told Bloomberg that it now expects the U.S. to see a marked increase in SRCC losses this year.

“We live in an era of high risk,” said David Flandro, head of industry analysis and strategic advisory at Howden Re. And the outbreak that made headlines in the U.S. “clearly indicates a broader trend,” he said.

Global civil unrest is on the rise, a development that has coincided with measurable increases in levels of inequality and polarization in some of the world’s wealthiest countries. In most Western countries, for example, the majority of citizens do not expect an increase in intergenerational wealth, according to the Pew Research Center.

According to Verisk Maplecroft, growing political divisions are increasing SRCC risks in both Europe and the US. However, the biggest increase in the size of the protests is happening in the United States, Varesk said in December.

Read more: Predictive model provides insight as insurers, reinsurers prepare for more civil unrest

According to first-quarter data provided by Verisk Maplecroft, when it comes to ranking countries at greatest risk of SRCC, the United States is the No. 1 Western democracy and ranks No. 5 overall, ahead of Pakistan, Bangladesh and India. France is ranked seventh. SRCC models take into account not only the risk of unrest but also the cost of replacing damaged property.

“It’s fair to say that the SRCC threat landscape has changed fundamentally,” said Torbjorn Soltodt, associate director of political violence at Varesk.

For a long time, insurers have offered protection against SRCC at no additional cost. However, the heightened risk environment means it is becoming less common and property insurers have begun to exclude or limit cover for SRCC from their policies, according to Cara Brown, vice president of terrorism and political violence at insurer Chubb.

SRCC coverage is usually added to other insurance policies, although there is evidence that the increase in such risks is prompting companies to start looking for specific cover. At the same time, Howden Re said as early as 2023 that insurers are starting to charge “significant additional premiums” for SRCC coverage, with retail assets the most affected.

More than two-thirds of multinational corporations are already using political risk modeling tools, Hodden-Re says. And in 2024, Lloyd’s of London — the 338-year-old insurance market — assigned SRCC its own code risk. In 2025, Verisk released its first SRCC catastrophe model, focused on the US market.

Reinsurer Swiss Re says it received just a couple of dozen SRCC claims in the early 2000s, and that number has since grown to hundreds. We’ve continued to see a couple hundred per year in recent years, which is “indicative of market trends.”

A Changing America

In the US, several data tracking services show that the number of political protests is increasing. Meanwhile, perceptions of America are changing, says Stephen M. Davis, senior fellow at Harvard Law School’s Program on Corporate Governance and co-founder of the United Nations Principles for Responsible Investment.

He said that seeing America as a “safe haven” is a thing of the past. This is because “there is volatility in policy that exists now” that can be seen “both internally and externally”.

It’s a sentiment that is playing out in markets, as some institutional investors in Europe look for ways to reduce their exposure to the US.

For insurers, calculating reliable loss risks is proving difficult to model and Soltvedt notes that protests don’t always lead to property damage. In Minnesota, for example, where Immigration and Customs Enforcement officers killed two U.S. citizens, protesters conducted themselves in a way that resulted in “so far limited direct impact on commercial property or private property,” he said.

The Trump administration is now backing away from its immigration enforcement blitz in Minnesota, pulling back after more than two months of operations.

But given the overall pace of development at SRCC, the possibility that a single incident could result in losses of more than $5 billion cannot be ignored, according to Verisk Maplecroft. It said that in some areas, the risks of SRCC damage may be greater than the risks from natural disasters.

SRCC as a standalone insurance product “used to be a very niche, niche business,” said Serdjan Todorovic, head of political violence and hostile environment solutions at Allianz Commercial. But several major events in recent years “have hit the industry hard and dampened the market.”

Related:

Copyright 2026 Bloomberg.

I am interested. Civil unrest?

Get automatic alerts for this topic.