According to a Moody rating report, insurance renewal rates are decreasing during January this year’s January, but US property-custody insurance prices are likely to be stable during the upcoming Central renewal.

“The upcoming mid -2025 insurance renewal, which is focused on the United States, will be affected by major casualties in the past one year – especially Hurricane Helen and Milton and Los Angeles Wild Fire – which provide insurance prices, providing insurance prices, supporting the prospect of refusal.

As a result, Moody believes it is likely that the US property will continue to stabilize destructive insurance prices, “the ability to increase prices for widespread accounts over the past one year will be supported.”

In January 1, 2025, Moody said, moderate risk prices for property coverage have dropped, however, noting that prices are dependent on the geographical region and whether the accounts suffered losses last year.

In the past several years, despite the global insured disastrous losses, “insurance companies have reported strong results as more associated points for property destructive insurance, which has improved underwriting results for insurance companies, which has promoted investment in this field,” said Moody.

January insurance renewal

In general, the global insurance company’s 40 % and 60 % are renewed on January 1, including a large majority of European businesses, Moody continued.

“Several European -based global insurance companies reported premium growth for insurance business that was renewed on January 1, as firms tried to deploy capital in a priced environment. Due to the operations, the aim is to reduce the business not to meet its return. “

Moody said that prices were usually flat in part folisies of these European insurance departments, which was reduced by 2.1 %, which has been reported by Hanover RE, which has been reported by the Swiss RE. “For its non-basic business, the SCOR reported the first price reduction (-0.8 %) after the January 2017 renewal.”

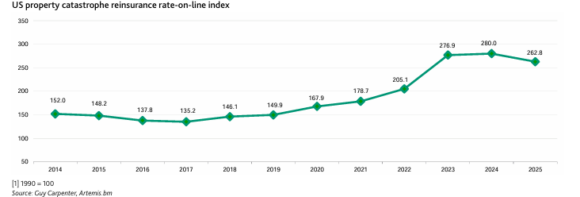

For the key part of the US property destructive insurance segment, the insurance broker cow carpenter reported a 6.2 % reduction in the total prices of January, which fell the first after the January 2017 renewal period, which identified the elimination of the soft market for insurance.

“Generally, pricing was mostly stable in working layers – the lower levels of insurance used for more frequent and small claims. However, at the upper end of insurance programs, pricing was low, where there was enough potential for low frequent and large claims coverage, for which pricing is on the risk.

Crash business

Beyond property painters, Moody said, the accident business prices were mixed and the performance of individual contracts was mostly relied on.

Moody’s insurance broker Galgar Rei said that it was a flat of 10 % for European casualties and 10 % for damaged accounts. “In the United States, the normal responsibility is reduced by 5 % to 5 % to 5 %.

The report states that the seeding commission was widely stable in January’s renewal, “because in recent years, insurance companies were on the line of payments to insurance companies after increasing cost trends due to social inflation.”

Source: Moody rating

Photo: On February 25, 2025, this satellite image provided by CSU/Ciraa & Noaa has been taken 1:10 GMT, three storms are shown in the southern Pacific, east of Australia, Alfred, Cero and Rae. (CSU/CIRA & NOAA AP, by file)

Related:

Titles

Destructive USA Insurance Property

Is interested Devastation?

Get automatic warnings for this title.