The 2025 Solar Risk Assessment Report, recently released by KWH analysis, has given rise to a significant conversation among industry professionals about the developing challenges facing renewable energy assets. To deepen the results of this report, KWH analytics called for its renewable energy broker council, which collected leading insurance brokers who specialize in solar and battery storage to share their views on the industry’s highly stressful risks. The council provided these experts a platform to discuss the results of the report and identify strategies for stakeholders.

The Broker Council consisted of the following participants: Rob Betton Field (Emuns), Todd Berke (Mac Griffe), Mike Cosgroo (Renewable Guard), Brian Fitzerland (WTW), John Katlos (AON), Jeraldine Carrien (CAC), Alex Post (Alex), Alex Post (Alex), Alex Sulaimic.

Heel Risk Faced

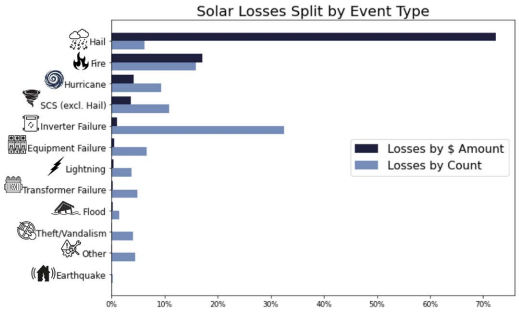

The diagnosis of the solar risk of 2025 described Ole as the dominant cause of solar losses, which, despite representing only 6 % damage, causes 73 % loss of loss. This search echoed firmly with the brokers, who emphasized the importance of strong haul defense strategies and the evolution of more data -driven ways.

Mike Cosgigo, who belongs to the renewable guard, emphasized how the client is embracing more sophisticated risk engineering: “With our clients who are really resonating, VDE is asking resources like VDE America to see the effects of flexible measures with models.

The council discusses how the industry is moving towards the heel defense protocol, which shows a reduction in the risk of measurement.

Selection of technology and access to market

Most discussions are focused on how module selection and technology selection are becoming increasingly necessary to achieve proper insurance coverage. This conversation revealed a change in market dynamics, as McGraf’s Todd Burke highlighted: “Since the insurance company has become more sophisticated, the site’s flexibility is less than an option, because without it, the insurance will not only participate. It is a flexible asset to get an admission to the market.

This shift represents the maturity of the insurance market, where careers are only moving beyond prices toward quality, by distinguishing the premium based on specific flexible measures, such as thick glass modules in heel -infected regions. Legacy technology or inadequate flexible steps may not be able to secure coverage at any cost, basically changing how the developers approach the selection of the equipment and the design of the project.

Insurance shopping challenge

Despite significant investment in flexible technology and engineering analysis, brokers identified the disconnection between technical risk diagnosis and insurance purchase requirements. This vacuum has created frustration in developers who invest in sophisticated danger measures, but do not see a similar shortage in coverage needs.

Marsh -related Luke Sulaimak highlighted the industry’s challenge: “Today, assets owners invest in halla flexibility with the racking system at 50 degrees or more levels, and to show their benefits to the Muslim League’s loss study, they are prepared to run the limits of freeing. Yes.

The brokers acknowledged that by navigating these contradictory requirements, they were in a difficult position between the interests of their clients and the standards of the conservative industry. WTW -based Brian Footzerlda emphasized the responsibility of the broker in these situations: “We have the responsibility to help customers buy the right amount of insurance, not essentially not to feed coverage.

It highlights the need for better alignment between disconnected engineering studies, insurance needs, and the original risk profiles of modern flexible solar projects.

Battery Energy Storage System: To navigate to early stage risks

The rapid growth of the battery energy storage system significantly featured the debate, brokers are sharing their own experiences about the significance of commissioning and early operational stages. The results of the EPRI in the diagnosis of the solar risk of 2025, saying that 72 % of Bess failure in the first two years, resonated with the group.

Eon’s John Katros offered insights directly from the loss experience: “Aon’s claims have seen a small number of low commissioning losses to the battery energy storage system (BESS) forms.”

“Hot testing” usually refers to the phase where the Bess system is dynamic and begins to work with the desired power sources and control system. This is an important step where the entire system, including battery management system (BMS), Power Conorrision System (PCS), and plant controllers, is tested in real -world conditions.

One of the major parts of poor workmanship is the loss factors. The hot commissioning period is also one of the risky stages during the cycle of construction project. A phased approach during commissioning, such as commissioning the entire site, will significantly limit the exposure to overall damage.

Data quality and risk assessment challenges

Brokers strongly supported the insurance industry’s further sophisticated risk diagnosis, highlighting the ongoing data collection and standardization challenges.

Emuns’s Robbatnfield highlighted the disparity in the market approach: “All insurance stakeholders do not understand how to ask the right questions and to separate the customers together to write the data together. Space is not a better way to help the brokers make it better. As a result of the risk of risk, it may not be helpful in communicating, but can also help to communicate, but it may not be that they can only improve effective risk transfer but also help to communicate.

The debate also revealed the challenges around wide data without a clear decision -making framework. Alex Post notes data Paradox that the industry is facing: “We have almost Almost a lot of data and often contradictory modeling information, which creates uncertainty about which data should be trusted and the owners of the assets are difficult to make informed insurance decisions. Looking for proper balance.

The brokers also created action to take action for the industry to collect data and improve documents. Geraldine Carigan, a CAC specialty, highlighted a key lost factor: “We would like to see the client to see when Hell Falls and nothing happen to us.

These positive issues of successful risk reduction can help show the value of flexible investment and push the industry towards further proportional risk diagnosis methods.

Future views and industry recommendations

The key paths of discussion are these:

For developers and asset owners: Invest in early flexibility measures in the development process and maintain comprehensive documents to avoid risk efforts. Focus on proven technologies and strong operational protocols, especially for projects in already already developed areas.

For the industry: Develop a standard approach to measuring and value flexibility, especially for emerging technologies like Bess. Improve data sharing on both the successful events of the Risk Risk eliminating and the successful incidence of damage to the industry’s broader learning opportunities.

For insurance and brokers: Continue to advance premium discrimination that properly rewards active risk management while working to simplify the decision -making framework that can handle complex technical data.

The continued development of the renewable energy sector depends on the infrastructure designed to tackle the climate and operational challenges. Although there has been significant progress in understanding and managing the risks, the industry must continue to adopt because we face changing natural destruction profiles.

The obvious way forward for the industry is: Continue cooperation, focus on data -powered decision -making, and prefer active risk management.

Titles

Trends agencies