A rarity in the $55 billion market for catastrophe bonds is about to happen: A trigger event will wipe out 100% of the bond’s principal.

Jamaica’s $150 million cat bond has been the subject of controversy since it failed to materialize after Hurricane Brill devastated large parts of the island last year. This development calls for consideration of the appropriateness of such financial instruments for developing countries on the frontlines of climate change.

Investors in Billy Bonds are now hoping that the trigger event forced by Melissa — a massive Category 5 hurricane — will finally put such doubts to rest.

Read more: Insurance companies take most of Jamaica’s property exposure from Hurricane Melissa: reports

“It’s actually a good thing because the bond pays,” said Dirk Schmelzer, a senior fund manager at Plenum Investments AG, a holder of Jamaican cat bonds, in an interview. “It shows how cat bond structures can help countries get back on their feet.”

But skepticism towards the device remains.

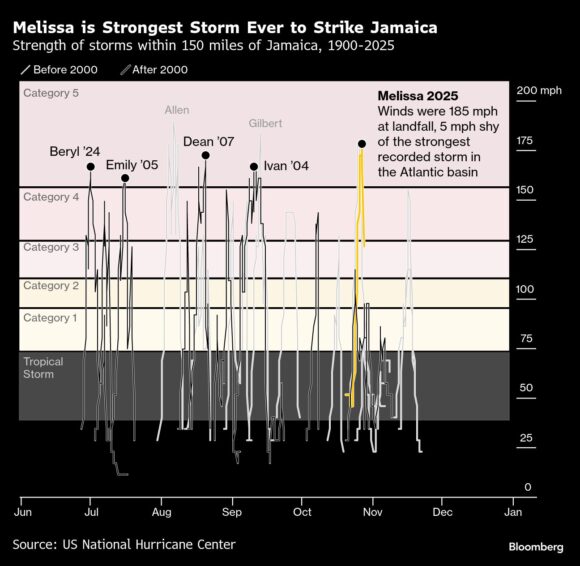

Jwala Rambran, former governor of the Central Bank of Trinidad and Tobago, says it took a “black swan” event to trigger the bond. “Melissa killed everything.”

Rembran co-authored a report by the Vulnerable Bases Group, or V20—a group of nations most exposed to climate change—that last year called for a deeper reassessment of sovereign cat bonds. After Barrell, the V20 warned that the bonds were becoming increasingly rigid in their structure, with narrow parameters that were shielding investors without helping poor populations.

Catastrophe bonds are used by issuers – mostly insurers but sometimes governments – to transfer risk to the capital markets. Bondholders risk potential losses if a default occurs, but also large returns if it doesn’t. Jamaica agreed to pay investors in its bonds a floating rate of 7% above US money market rates.

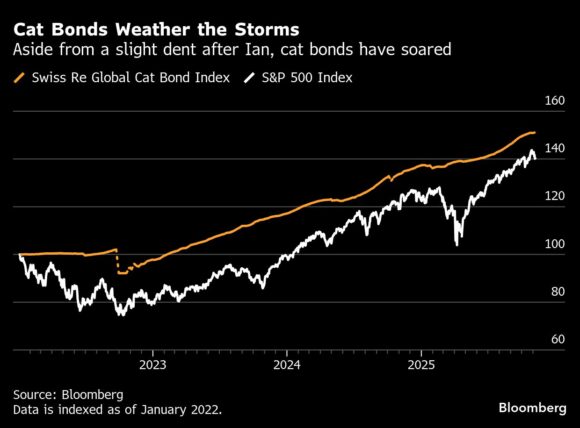

The last time a weather-related cat bond was paid in full was in 2022 in connection with Hurricane Ian. The Swiss Re Global Cat bond index slipped about 22 percent this year, but has since made record gains. In the three years since Ian, the Swiss Re index has risen 60%.

Jamaica has what is probably the strongest disaster management program of all the Caribbean countries. In addition to the $150 million it will get from its cat bonds, it can tap $300 million in emergency credit from the Inter-American Development Bank and draw $92 million in payments from the Parametric Insurance Program.

Insured costs for Hurricane Melissa’s beach property damage in Jamaica are now between $2.2 billion and $4.2 billion, according to data firm Verisk Analytics Inc.

A briefing on October 31 stated that the funds provided to Jamaica by its Billy Bonds and other instruments “will never be sufficient to carry out its rehabilitation and even relief work.”

At the World Bank, which handled Jamaica’s cat bond issuance, vice president and treasurer George Waqif said the island’s “comprehensive disaster risk management strategy and proactive approach serves as a model for countries facing similar risks and seeking to strengthen their financial resilience to natural disasters.”

“The payout underscores the role of catastrophe bonds in effective risk management strategies and their efficiency in transferring catastrophe risks to the capital markets,” he said.

But Remburn says that for the most destructive storms like Brill, there remains the risk that cat bonds are triggered. “We still need to look at their design and strike a balance between providing returns and doing good,” he says.

Meanwhile, investors exposed to Jamaica’s Billy Bonds are unlikely to experience any meaningful hit to their portfolios, according to Mara Dobrescu, director of fixed income strategies at Morningstar.

He said that “no one had a large amount” of Jamaican cat bonds in his portfolio. So investors will easily absorb any Melissa-related losses and continue with a “standout year.”

At Plenum, the expectation is that losses associated with its Jamaican bond holdings would leave a dent of just 0.23 percent on one of its two bullion bond funds, while the other would be untouched. Schmelzer said the asset manager has no plans to increase its interest in the World Bank-backed issue.

“From an ESG perspective we have a lot of clients who like to see these transactions in the portfolio,” he said. “Losses are losses, but it’s a better loss than other people.”

According to data compiled by Morningstar, major holders of Jamaican distressed bonds include New York’s Stone Ridge Asset Management LLC, UK-based Baillie Gifford & Co, and Scrudders.

Stone Ridge did not respond to requests for comment. Spokesmen for Bailey Gifford and Scrudders declined to comment.

The extent to which vulnerable countries should rely on capital markets to help cope with extreme weather is set to shape the COP30 talks in Brazil. Such questions also feed into the so-called Baku-to-Belarus Roadmap (a reference to the parties’ summits in 2024 and 2025), which seeks to mobilize $1.3 trillion annually for developing countries.

A study published in 2024 found that three years after a hurricane hit the Caribbean basin, debt levels were 18 percent higher than in the baseline scenario.

And in a statement on social media, the World Food Program drew attention to the level of devastation in Jamaica.

In its statement on Friday, the World Bank said the catastrophe bonds are part of its Crisis Preparedness and Response Toolkit “which provides developing countries with an advanced suite of tools to better respond to crises and prepare for future shocks.” It aims to provide “rapid access to cash for emergency response, extended disaster insurance and an option to suspend debt service payments in the wake of natural disasters.”

Read more: The World Bank says Jamaica is on track for full repayment after devastating bond hurricanes

In the case of Hurricane Melissa, the extent of the damage is going to be so great that Jamaica will not have enough funds to cover the extent of the damage, even with the level of funding already agreed upon, Rambran said. “

Melissa’s impact on Jamaica “presents us with a big problem,” he said. “We need a global financial architecture that can deeply support these countries.”

PHOTO: In this handout image released by the U.S. Air Force, a crew flies through Hurricane Melissa over the Caribbean Sea on Oct. 27, 2025. Photo credit: US Air Force

Related:

Copyright 2025 Bloomberg.

Titles

Destruction