According to data provided in Florida, according to data provided by Florida regulators, consumer complaints about property coalty insurance companies in Florida have over doubled over the past five years and are on the way to reaching a new height in 2025. Insurance industry sources said that these numbers cannot be trusted because they need mediation and assistance, which are not real complaints.

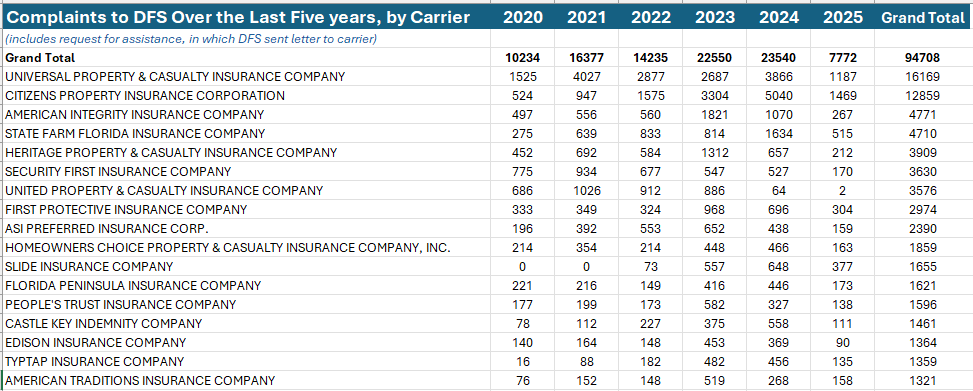

The Department of Financial Services released the Insurance Journal data, showing that the total complaints about 326 insurance carriers of residential policy holders have increased from 10,219 to 23,400 in 2024 in 2020. If the trend of 2025 continues, complaints may be 31,000 this year. In recent years it has a large number of complaints of about 95,000 complaints.

The DFS has received the most calls about the Universal Property and Costrooquet Insurance Company, one of the largest insurance insurances in Florida. During the five -year period, the DFS recorded 16,170 complaints about the Universal. These are significantly higher complaints than the regulators based on the Citizen’s Property Insurance Corporation, which is the state’s largest property carrier, which has about 200,000 more policies to Florida compared to Universal Holds.

US integrity insurance and state form Florida Insurance secured first and fourth, with about 4,700 complaints, with about 4,700 complaints. Heritage Property and Castry Insurance and Security First Insurance came in fifth and sixth, with 3,900 and 3,600 complaints respectively in the five -year time frame respectively.

The data mostly includes complaints about the types of residential policies: home owners, condominum unit owners, residential fires, mobile homes, tenant insurance, storm storm and flood coverage.

The majority of complaints were from HO Policy holders: about 888,000 during this period. For all types of residential policies, most of the complaints were about claims, followed by relatively small complaints about premiums, agents and adjustments. The DFS did not provide actual complaints or details about the nature of each allegation.

Despite questions about the data, people in the industry say that between insurance and complaints. For a number of reasons, there is an increase: Premium has increased constant for most homeowners in Florida in recent years. Other reasons include an increase in national and state news, including changes in the profits of some insurance, as well as unpaid and low -paying claims. Some people have argued that more complaints have been reported outside the courtroom as a result of the 2023 boundaries related to the claims of the claims. And in the last four years, three major hurricanes have caused thousands of properties across the state to increase storms and damage floods.

“Particularly for 2024, Helle and Milton were floods and wind incidents,” said Professor Charles Nes, chair of Risk Management and Insurance Department at Florida State University. “Many landlords do not think that air -powered water is still a flood incident and your home does not cover the insurance policy of the owners. This makes difficult claims and there are many complaints.”

In February, Florida’s insurance commissioner Michael Yavaski resurrected the issue of consumer complaints. He warned warning insurance companies, including your flood insurance companies, about the increase in complaints. Yurski noted that the storm claims, which have been misconcased for harmony, will not be tolerated by the department. The memo persuaded the insurance journal to request a total data from the DFS, which handles some complaints and some dispute resolution for consumers.

DFS data shows that complaints about flood insurance claims increase every year, but in the last five years, there are still more than 500. Statistics show that during the 8th of April this year, by April 8, flood complaints have increased and if the trend continues, it can be at the top of 470.

Most of the complaints recorded by the DFS appear to be related to non -flooding policies. For example, for universal property and accidents, the number of complaints has increased in recent years but has increased from 1,525 to 2024 in 2020.

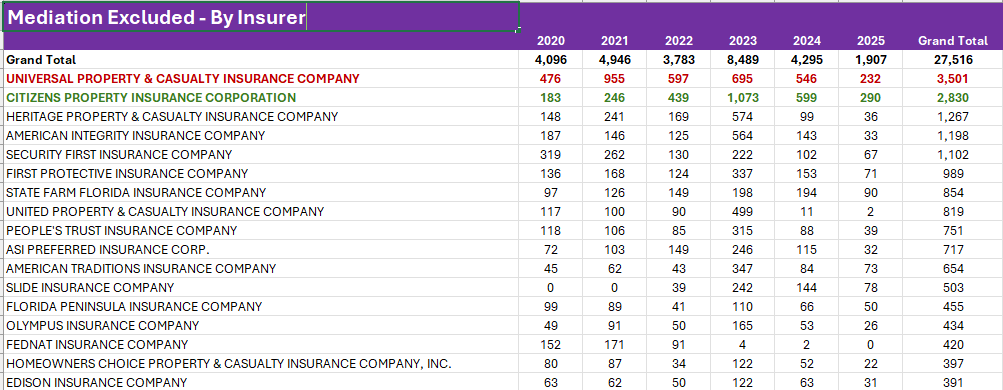

Universal Chief Attorney, Travis Miller, said that the DFS database does not give an accurate picture. For those starting, the DFS includes consumer issues that were determined by the DFS’s own mediation process, or were slightly higher than the requests for policy holders, which most states do not understand real complaints.

At first glance, one can assume that the number of arbitration is a fair game, as the possibility of this process has begun with policy holders’ complaints.

Miller said, “But the legal action, and the number of DFS complaints do not take legal action.”

The DFS data shows that without joining the mediation, the number of complaints is very low and in 2020, from about 4,000 to 2024, from 4,250, for all carriers, only increased slightly. If this year’s trend continues, however, that number can reach about 7,600. The number of complaints resulted in mediation or legalization is not tracked through DFS, but it is likely that many complaints are double counting, once a relief request and then as a mediation.

Miller said in an email, “We are not familiar with any other state in 20 in which the company operates, which dramatically enhanced the data, which increases such data as ‘complaint’ data, which includes such an illegal process of unlawfulness, which is unrelated to the Florida. Should be explained. “

A DFS spokesperson did not fully explain why arbitration data was included in the grievance of the complaint.

“Arbitration is a program in which users contact the DFS division of consumer services to help resolve their insurance claims,” said William Patrick, director of DFS Deputy Communications Deputy Communications. He said that legal action is a civil case filed in the courts, for which the division of the department and consumer services does not participate.

The DFS Communications Director explained that calls to help many users are resolved by the department without further action.

DFS detects another data set – letters sent to insurance companies when a clear violation of the law through a user’s complaint carrier reveals. That number has increased from 2020 to 2023 but has since dropped.

Some southern states have reported very few complaints than Florida. In Georgia, a half -populated state of Florida, the Insurance Commissioner has said that his office receives 10,000 to 11,000 complaints about insurers every year. Texas, with a third higher than Florida, has seen 5,500 consumer complaints regarding residential insurance companies in 2024. Texas insurance complaints are on the rise, however, starting only 2,013 in 2020 and has climbed almost every year every year, according to the Texas Department of Insurance.

The Universal Attorney noted that Universal’s own data shows that the “true complaints” have fallen from 2021 to 2024. Miller did not provide the actual number on these complaints. Miller said the DFS includes minor requests to help with the complaint data, such as when the policy holders seek contact with their insurance company.

Nes said that comparing the universal with the insurance of citizens of Florida could not be a proper measurement stick.

He noted, “Citizens have a large part of the market in the Tree County region (near Miami).” This is not a place where hurricanes have been targeted in the past few years. The storm has been more Gulf coast and panchand, where citizens are not necessarily the biggest insurance. The larger parts of the market affected in the market, more claims and more opportunities for unhappy consumers. “

Miller argued that it is unlikely that many major insuranceists, some of whom are famous for their claims and customer service, will see such a large leap in the original complaints of policy holders. Like the Universal, other carriers are also being examined by regulators and lawmakers, and they have extended their efforts to pay for claims and pay on time, and other people in the industry claim.

Universal and others have focused on another step of consumer dissatisfaction – claims claim. Regulators data shows that insurance in Florida has declined dramatically as lawmakers have eliminated one -way attorney fees at the end of 2022 and have put new barriers to bad claims, both of them have eliminated legal action.

Industry experts say that in some ways, complaints should be expected to increase, making ranging changes in the Florida market over the past decade.

“Insurance companies have taken less accommodation in claims due to legislative changes, and there may be more complaints,” Nes said. “But, in addition, more claims of more stormy than the wind and more complicated claims than the air through more premiums will also lead to more unhappy with the insurance product.”

He added that consumers will not be happy with insurance unless they feel that the premiums are in accordance with the price of the product they are buying.

Titles

Career Florida