European Council President Antonio Costa said leaders were ready to make another push to unify their markets, arguing that a fracturing world order could be forced to act on reforms.

“My sense is that there’s a real commitment to all the leaders, and there’s a clear sense of urgency among all of them, that we need to effectively make decisions with impact now,” Costa told Bloomberg News.

That’s what Costa wants to discuss on Thursday, when he gathers all 27 EU leaders in a centuries-old Belgian castle for a day-long retreat. However, according to people familiar with the plans, leaders will discuss ways to integrate EU markets, give priority to EU companies in public contracts and EU contracts and ease rules for creating large EU companies. The leaders will then meet again in March to finalize their plans.

“We have to make sure we have a real European capital market to fund our companies, fund innovation and stay competitive in the global market,” Costa said.

The remarks echoed calls from Europe’s economic leaders in recent days, who have come with a dire warning: If the continent doesn’t hurry these stalled reforms, it will hasten its demise.

Such a concept is not new, of course – Europe has long argued that thawing its economies would help the continent compete with the US and China. Yet leaders have repeatedly failed to follow through, mired in logistical complications, infighting and shifting attention spans.

EU leadership in Brussels, including EU executive Ursula van der Leyen, has also been accused of not moving economic reforms.

Costa argued that leaders have become more emboldened after US President Donald Trump threatened to seize Greenland and China’s willingness to disarm supply chains.

“The geo-economic situation is a very important incentive for leaders to move forward,” Costa said.

Van der Leyen, who runs the European Commission, had a similar message when speaking to EU lawmakers on Wednesday morning.

“It’s our urgency mindset that we need and we’re going to stay the course until we get it all done,” he said, promising to propose a single market “roadmap” with timelines and commitments to implement the changes.

He said that EU leaders will endorse the plan at their March meeting.

Business leaders are watching to see if this time, it’s for real.

“The current geopolitical changes could be a real opportunity for Europe,” Deutsche Bank Chief Executive Officer Christian Salai said in a statement on Wednesday. “However, right now, we are still playing below our potential. We need ambitious and substantial reforms.”

The problem

Given that Europe is not a military power, the continent’s best hope for a global voice is its vast single market. The bloc accounts for about 15 percent of the world’s gross domestic product, with about 450 million potential consumers.

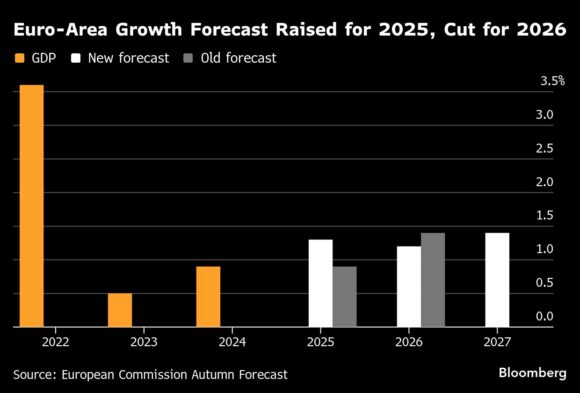

Still, the EU’s economic footprint is fading. In 2010, the EU’s GDP rivaled that of the US and was well ahead of China. Since then, it has fallen behind the US and now sits alongside China, according to the International Monetary Fund.

“We have the second-largest economy in the world, but we’re running it with a handbrake,” van der Leyen said on Wednesday.

EU leaders and top economic officials say the single market can still be powerful – if it is used effectively. Currently, he says, internal barriers mean businesses struggle to grow, workers can’t move easily and money sits idle, absent. It has left Europe crawling while the US and China walk.

“Europe’s convergence engine is stalling,” IMF managing director Kristalina Georgieva said last week in talks with EU commissioners, who help shape the bloc’s policies. “It faces an incomplete single market and autonomy about what it has to do to compete in today’s and tomorrow’s world.”

Van der Leyen tried to put a positive spin on this fact during his speech.

“The good news is,” he said, “it can be fixed.” “

Possible action

Costa said Thursday’s retreat “is a good moment” in the situation.

A Deutsche Bank research note published on Monday said the EU had shown only “incremental” and “limited” progress on its competitiveness agenda, with more focus on practical plans than actual changes over the past year.

However, the note said Thursday’s gathering could signal a “revival of EU economic policy”, citing leaders’ “increasing sense of urgency”.

Ahead of the event, officials have been touting their preferred economic policy ideas in speeches, letters and closed-door conversations.

The German and Italian governments argued in a paper that they circulated with a number of proposals. “Europe must act now.”

The countries of Europe’s two largest economies have pressed the EU to fast-track permits, adopt routines on outdated rules and strictly scrutinize new rules, with leaders regularly informed of progress. He also advocated for Europe-wide stock exchanges and looser merger rules, allowing European companies to outcompete and compete with America’s tech giants.

Costa largely agreed, saying the EU should “look at our competition rules” to “allow companies to be competitive in the global market.”

The European Central Bank also joined the conversation, sending EU leaders a five-point checklist. He urged leaders to finally unify the bloc’s 27 fractured financial systems, allowing money to be saved and invested across national borders.

Additionally, the ECB reiterated its call for a digital euro, arguing such a move would help Europe adapt and create local alternatives to foreign payment systems.

EU officials and diplomats have raised the idea in recent days as part of discussions about Europe’s reliance on US financial services, according to the people, who spoke on condition of anonymity to discuss private negotiations. Officials are exploring whether they can break the hold that U.S. payments firms like Visa or MasterCard have more of a stake in Europe’s transactions, or whether the dollar’s importance to international exchanges can be reduced.

Costa argued that Europe-based digital options would help weaken those ties.

“It is clear that we need a digital payment infrastructure in Europe to allow us to pay without any dependency,” he said.

French President Emmanuel Macron also plans to bring up exchange rates at Thursday’s meeting, with the euro gaining strength against the dollar. Currency appreciation can help reduce import costs, but it also creates a headwind for exporters, potentially holding back growth.

Other countries will have constant concerns about energy costs, which are double those of the United States. Energy-related industries like the chemical sector are sounding the alarm that if prices don’t come down, manufacturers will go under.

Here again, Costa argued that a single market would be supported with targeted investment in low-carbon technology and other sectors.

Sitting in on Thursday’s meeting will be some of Europe’s economic elite, including former ECB president Mario Draghi, who is warning that the EU is not moving fast enough on its proposed changes.

Draghi and other economic leaders insist that completing their long-sought reforms will substantially narrow Europe’s gap with the United States—and help it survive on its own if needed. Georgieva said that IMF research showed that the EU could increase productivity by 20% if it reduced the frictions in the EU’s internal market.

Costa said there is also an existential reason for reforming the EU’s economy in keeping with global power.

“I don’t say that the rules-based order is dead and we need a new sprout,” he said. “Of course it’s a risk, but I think we’re strong enough to protect the rules-based order.”

“The alternative,” he added, “is chaos.” “

Photo: Antonio Costa in Brussels on February 10, 2025. Photo credit: Victor Dubkowski/Bloomberg

Copyright 2026 Bloomberg.

Titles

Europe