According to the latest Global Insurance Market Index published by Marsh McLennan’s insurance brokerage Business Marsh, average global commercial insurance rates fell by an average of 4.4% in the third quarter of 2025, repeating the 4% decline recorded in Q2 2025.

Q3 marks the fifth consecutive global quarter of decline after seven years of quarterly increases and is a continuation of the moderating rate trend previously recorded in Q1 2021.

Marsh said that increased competition among insurance companies, combined with higher insurance premiums, were the primary drivers for rate reductions along with increased market capacity. .

All global regions experience year-over-year composite rates in Q3 2025. The largest overall rate declines were in the Pacific (down 11%), Latin America and the Caribbean (down 6%), and the United Kingdom (down 6%).

Asia and India, the Middle East, and Africa (IMEA) each declined by 5%. 4% in Europe by ; and 3% in Canada. The overall composite rate in the US – which was flat in Q2 2025 – declined by 1%.

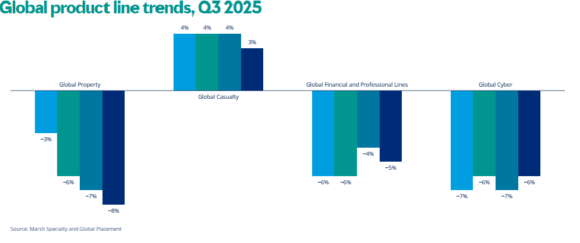

Every region saw declines for property, cyber, and financial and professional insurance.

Other findings in the Q3 report include:

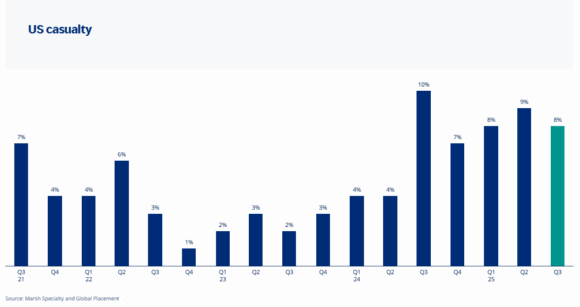

- Global casualty rates increased by 3%—down from 4% in Q2 2025—driven by an 8% increase in the U.S. driven by the frequency and severity of mass casualty claims, many of which feature large (so-called “nuclear”) jury awards.

- Cyber insurance rates fell 6% globally, with every region seeing declines, including double-digit declines in Europe (12%). LAC and UK (11%); and the Pacific (10%). Cyber insurance rates in the US have dropped by 3%.

- After a 7% drop in Q2, global property rates fell 8%. The Pacific (14%) and Americas and LAC (9%) regions experienced the largest declines, while all other regions saw declines between 3% and 7%.

- Rates for financial and professional lines continue to decline, down 5% globally in the third quarter compared to a 4% decline in Q2 2025. Rates have declined in every region, from 10% in the Pacific to 2% in the US.

In addition to the US crash, clients are benefiting not only from lower rates but also opportunities to negotiate better terms and broader coverage, in a statement. “

Donnelly added, “These rate trends remain consistent in a market with considerable capacity. Barring unexpected changes in conditions, we expect these trends to continue and look forward to helping clients take advantage of the competitive insurance market.”

*Note: All references to rates and rate movements in this report are averages, unless otherwise noted. For ease of reporting, Marsh has rounded all percentages of rate movements to the nearest whole number.

Related:

Titles

Commercial Lines Trends Business Insurance Pricing Trends

There is interest Business insurance?

Get automatic alerts for this topic.