As London struggles to come to terms with the reality of more frequent and powerful floods, its wealthier corners are emerging as something of a threat.

Last month in the affluent London neighborhood of South Hampstead, homeowners filled a community hall for an event dedicated to preparing for the next big flood.

The participants had good reason to be there. South Hampstead – where the average house price is more than £1 million ($1.3 million) – stands as one of the areas most likely to be affected by flash flooding in July 2021. At that time, a month’s worth of rain was dumped on London in just a few hours. Some of the UK capital’s wealthiest boroughs – Kensington, Chelsea and Westminster – were among the worst affected.

It was a seismic event that changed people’s perception of what it meant to live in London. Guy Meacock, director of UK property-buying consultancy Prime Buying, says flood insurance for homebuyers “wasn’t even talked about years ago”. But it’s “a much more real problem now.”

Homeowners living in some of London’s priciest real estate are now trying to figure out how frequent and devastating floods will affect both their access to insurance and their property values. It’s just as rising temperatures are affecting cloudburst patterns in ways that are exposing established urban areas with aging Victorian-era infrastructure under extraordinary stress.

Rachel Gilliam, head of private clients at Lockton, an insurance broker, says the special design of a high-end property can often increase flood risks. City gardens with well-kept driveways and hard-surfaced lawns enhance water flow. And below ground, luxury basements that house everything from supercars to art and technology.

Gilliam, who declined to identify individual properties or clients by name, says he has seen a single claim for the 2021 flood in the Notting Hill area claiming more than £600,000. She says another in Hempstead was over $1 million.

Londoners are caught up not only by rapidly evolving weather patterns, but also by changes in regulations and shrinking access to insurance.

Meacock at Prime Buying, who also declined to identify clients because of the sensitivity of the matter, says the risk of flooding was a deal breaker for buyers he was advising on a multi-pound house in Wimbledon last year. The house, which Meacock says had never flooded, even had state-of-the-art flood protection, including an underground pump. But it also had a basement, which was added as part of a major renovation in 2010.

Insurance companies deemed the property ineligible for flood RE coverage, a government-backed insurance plan that is not available for properties built after 2009. Buyers tried 10 different insurers through two brokers. Most of the time, Mack says, it was just a case of “computers saying no.”

After spending around £30,000 on legal and survey fees, the buyers finally found an insurance company willing to cover the house. By that point, they were independent enough to finally choose a different property without a basement, Mack said. Now, whenever he takes on a new client, he insists that they check early in the process to see if the property can be insured for flood risk.

Luxury basement

Homeowners with premium properties and large basements increasingly face their own unique risks. Since the 2021 floods, insurers have been offloading such homes for flood RE, which saw a 20 percent jump in policies in the fiscal year through March. Flood Re has consequently increased the premiums it charges insurers by up to £1,600 a year per household, as its risk profile evolves to reflect more high-value claims..

“Insurers won’t need to be flooded,” says Ryan Clay, associate director in the new business department at insurance broker SPF Private Clients. “The Flood RE itself is intended as a stopgap that is due to expire in 2039.

Londoners are sheltered from the worst river floods by the Thomas Barrier, a 40-year retractable flood defence, which protects the city from storm surges and tidal flooding. It is expected to be effective until 2070, after which rising sea levels mean it will no longer be fit for purpose.

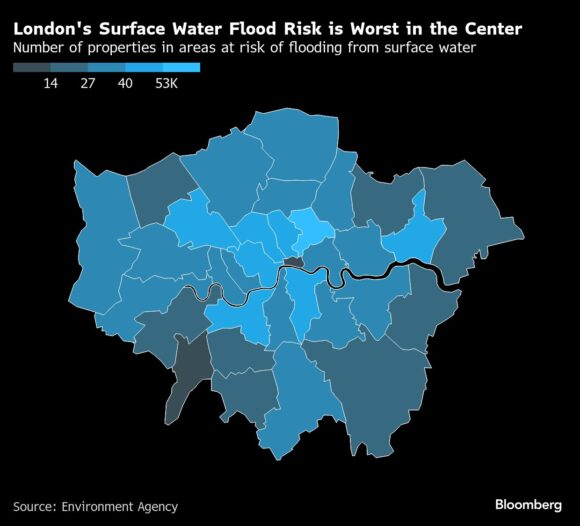

But Elizabeth Rapoport, chair of Flood Ready London, a partnership between government officials and the local water company, says homeowners often mistake misconceptions for where the real risks lie. “If you’re worried about flooding in London, the rivers aren’t your problem,” she says. “You should be worried about surface water.”

She also says that “London has a lot of wealth” due to “the fact that the land is so large.” But if “you can’t get insurance for the building on it, values really start to drop.” It’s “like a house of cards.”

Rapoport says the challenge is set in a city with a difficult patchwork of landlords and unclear responsibilities. She emphasizes that the people most at risk are those living in basement flats who cannot afford expensive protection, and where flash flooding can be life-threatening in extreme scenarios. In July 2021, East London was experiencing severe flooding, affecting roads and public transport.

As more and more homeowners in London look for quick fixes to help their homes flood, some businesses are looking at an opportunity. Watertight International, a flood resilience company based in the north-west of the UK, is now planning to expand into the capital, says director of operations Mark Arrowsmith.

Standard solutions include pumps, self-sealing vents, and waterproof doors and gates, as well as valves that can be attached to pipes to prevent sewage from draining into the home after the water level rises. Watertight, which presented many of these solutions to residents at a South Hempstead event in October, also provides customized flood plans that not only include advice on home safety, but also how to plan an escape if water levels rise at an alarming rate.

Mary Long Dhaneau, who has been advising UK flood victims and campaigning for their rights for 25 years, was among those at an October community hall gathering in South Hampstead.

“I’ve been flooded myself – I know what you’re all going through,” he told the audience. “Recovering from flooding is worse than flooding.”

PHOTO: Properties burst their banks by the River Thames after heavy rain near Kew Bridge in London. Photo credit: Justin Satterfield/Getty Images

Copyright 2025 Bloomberg.

Titles

London floods