Lloyd executives said the market has continued its price by providing 6.5 % premium growth while maintaining underwriting discipline to stakeholders.

Lloyds saw a continuation of a positive profit with a profit of $ 9.6 billion ($ 12.4 billion) during 2024, which was less than $ 10.7 billion ($ 13.8 billion) in 2023. The market achieved a joint ratio of 86.9 % for 2024, compared to 84.0 for fiscal year 2023. (The joint ratio below 100 indicates a written profit).

“It was 2024 a year when the market proved our inverting discipline and a profitable growth of 6.5 percent,” said Lloyd Chief Financial Officer Brecard Keys.

The Keys and Chief Executive Officer John Neil both spoke during the recent media briefing to discuss the entire year’s results of the 2024 Lloyd.

“The Lloyd market has been immense in achieving a sustainable profitable performance. We have been on a seven -year journey to provide the desired change to our stakeholders. And Aun’s climate solution unit chairman.

Nile said, “Since 2017, our track records itself. To date, we have been reporting a joint ratio of 86.9 % in 2024. We have reduced our basic joint proportion to 79.1 percent, (which has not excluded large claims), or from 2019 to 16 %, 16 %.”

“The key components of the joint ratio are moving positively. The important thing is, the proportion of irrational loss, the most directly under the control of the Androters, when they are at risk of selecting, management and cost, have been reduced to 47.1 percent and now it is less than 50 % permanently.

The market’s 2024 expenditure ratio remained flat with 34.4 2023, which Keys described as “a small frustration”.

The most important move

Both the Keys and the Nile focused on their commentary on the basic joint proportion of Lloyd, which Keys described as the “most important move …”.

“With 79.1 % with our basic joint ratio, we have achieved a profitable limit of 80 % in the third consecutive year, which once again proved how well our Lloyd system works,” Keys said, which is also retired from its CFO position this year.

Casey said, “The basic joint ratio of 80 % means that we can absorb the pure insurance of under -insurance insurance before we can absorb the pure deficit of our underworld (and the joint ratio increases above 100),” said Casey.

“Since our common big claims are usually about $ 4 billion ($ 5.2 billion), this flexibility assures both our policy holders and capital providers,” he said.

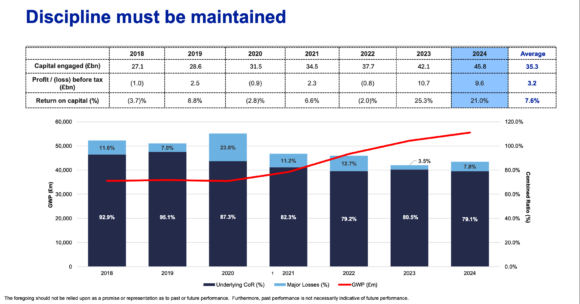

Case said that since 2018, Lloyds have achieved the top line of more than 50 % and its basic joint ratio has dropped from 93 % to 79 % in 2024, which represents an increase of $ 6.4 billion ($ 8.3 billion) in annual underworlding profits.

“Strong underworlding discipline is our North Star, and we expect the market to be permanently targeted by the basic joint proportion of about 80 percent. We have a strong investment of $ 6.3 billion ($ 6.3 billion) with a strong investment of $ 5.3 billion ($ 6.9 billion) in both sides of P&L. I underworlding profit was 9.9 billion and this year’s investment return was $ 5.3 billion).

Cause noted that Lloyd’s profit before tax is $ 9.6 billion, or less than $ 1 billion in 2023, but the reduction was expected after an extraordinary year of 2023 when NAT Kate activity was relatively low.

Although 2024 is the second consecutive year when Lloyd has been reported too much profit, Keys warned that the market should “not remove” – in other words, it should refrain from resting on its honor. “We have not received our capital costs in the last seven years, namely, in 2023 and 2024, the high profits were not enough to meet the results since 2018, and I believe it is very true for the entire industry,” he said.

Return to capital

“This means that we should maintain underwriting discipline. We can all agree that 7.6 percent of the return (on the capital since 2018) is not enough for the current and new investors. Without setting a particular target, of course, on the nature of the book, an investor will usually be expected to return to 15 %. “The return of 2024 on the capital of 21.0 % is less than 25.3 percent in 2023, which reaches 7.6 % of the seven -year -old average. See the graphic from above,,,,,,,,,,,, for centuries,,,,,,,.Note: The 2023 number has been corrected from the first version of the article.)

The return to the capital was 21 % for 2024, which is lower at a significant 25.3 % of 2023, but the average of seven years is now 7.6 %.

The Keys further explained during the question and answer session that investors needed to pay for their risks. “We have received a 7.6 percent return on capital in the last eight years, and we have to give investors the opportunity to return this money. And I think it will force discipline as the investor community in the insurance sector is still a special fatigue.”

Both the Keys and the Nile expressed confidence that the demand for investors for the nature of the risk of better profit and growth to Lloyd would not be widely relaxed.

“We are in an extraordinary world of protectionism, nationalist behavior and geopolitics,” Nile said Neil.

He said that the Lloyd is rising threefold the total domestic product rate while the global insurance is increasing doubled at the GDP rate. “So I understand that there are plenty of opportunities to see the threat, accept the risk for Andrights, but just accept the risk where the price is correct.”

In fact, Nile said the market 2023 and 2024 have shown discipline around the right risk cost – a trend that will potentially continue.

“The results of 2024 clearly show that the Lloyd market is in good shape, which is less due to performance, discipline and a sense of intelligence, Nile said in his rap comment. “And we will be in this position, we will be focused on inverting profits to provide extraordinary prices to our market, our investors and of course our customers, our investors and our customers.”

Related:

Titles

LIDE TRANSITIONS OF THE EXCLUSIVE PRICE PRICE